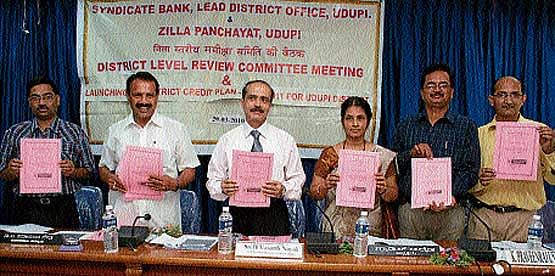

The credit plan was launched at the district-level review meeting held here on Monday.

The plan outlay for the last year was Rs 1,659 crore.

Addressing the meeting, Lead District Syndicate Bank AGM Vasanth Nayak said that the slow growth rate and low level of capital formation in agriculture sector in Karnataka and the high potential for lending to Self Help Groups (SHGs) offer a good scope for banks to aggressively lend to this sector in the district as well. If the targeted level of lending under agriculture sector (Rs 461 crore) is achieved, the sector can be revived in the district, he said.

He said that the low Credit Deposit Ratio (CDR) in the district has been an area of concern for RBI and the district administration which reveals that the excess liquidity with banks is not being used for the needy. Speaking after releasing the credit plan, Udupi-Chikmagalur MP D V Sadananda Gowda stressed the need for the banks to take steps through plans and programmes to encourage and promote agriculture which was fast declining in the district. “We will have to face a dangerous situation if precautionary measures are not taken in this direction,” he added.

He said that the Human Development Report 2008 for the district which was released recently has revealed low employment generation opportunities in the district, widening gap between rural and urban economies.

He said there is a need to introduce more vocational courses as rural and poor students can not avail the benefits of the professional courses. The banks should concentrate their attention on linking the credit plan with the Human Development Report of the district to bridge the gap, he added.

Nayak made presentation on the performance of the banks in the district during the third quarter, said that the total deposits of the banking sector comprising of 300 bank branches in the district stood at Rs 7,217 crore with a growth of 15 per cent and total advances at Rs 3,368 crore showing a growth of 11 per cent.

He said that the share of priority sector advances is Rs 2,444 crore. During the period, 2,734 farmers have been issued with Kisan Credit Cards (KCC) with a disbursal level of Rs 17.32 crore.

Kisan Credit Card is covering 17,640 card holders. Out of 18,969 Self Help Groups (SHGs) in the district, 18,691 have been credit linked, he added.

ZP President Gladys Almeida, CEO D Pranesh Rao, Lead Bank Manager B Sathyanarayan, K Praveenraj Udupa from NABARD and others were present.