Even before assistant commissioner L C Nagaraj’s report favouring I Monetary Advisory (IMA), the economic offenses wing of the Criminal Investigation Department (CID) had submitted a report in January this year concluding the investigation against the firm.

The report by then CID Inspector General of Police Hemanth Nimbalkar did not find any shortcomings in the manner in which IMA was operating and noted that no investor had come forward to file a complaint against IMA, according to documents available with DH.

Nimbalkar, who is currently the Inspector General of Police, (ACB), however, maintained the report only said the company did not attract any provisions under Section 3 of the Karnataka Protection of Interests of Depositors in Financial Institutions Establishments Act, 2004.

The report was based on an October 2017 petition from the Reserve Bank of India to the state government. The petition had sought the state to investigate IMA and its group entities based on the “input received by RBI from various sources.” These sources had inferred there was a “distinct possibility of unauthorised acceptance of deposits from the general public by the said entity. Therefore, necessary action may be initiated by the competent authority under the relevant provisions of the Karnataka PID Act, 2014,” the petition had said.

Following the petition, the CID questioned the currently absconding IMA managing director Mohammed Mansoor Khan and other employees of the firm, recording their statements. In its report, the CID noted the people who invested in IMA were “merely partners (of IMA) and not investors” as per the documents accessed by CID.

The report stated IMA was not a financial firm and “there was no supportive evidence to prove the company had collected money in the form of deposits from the public with a promise of more interest and more profit...” The report went on to note there were no shortcomings in Mansoor’s balance sheet and “nobody had personally come forward to claim they have been cheated.”

“...as per KPID Act, 2004, it was not legally possible to consider the investment by partners as deposits and since the action cannot be initiated under Section 9 of the KPID Act against the firm, action (also) cannot be initiated under section 3 of the act,” the report had concluded.

Nimbalkar told DH that the CID was mandated to probe whether the firm attracted any provisions under Section 3 of the KPID Act. “Since the Limited Liability Company did not attract the said provisions, the CID submitted the report,” he said.

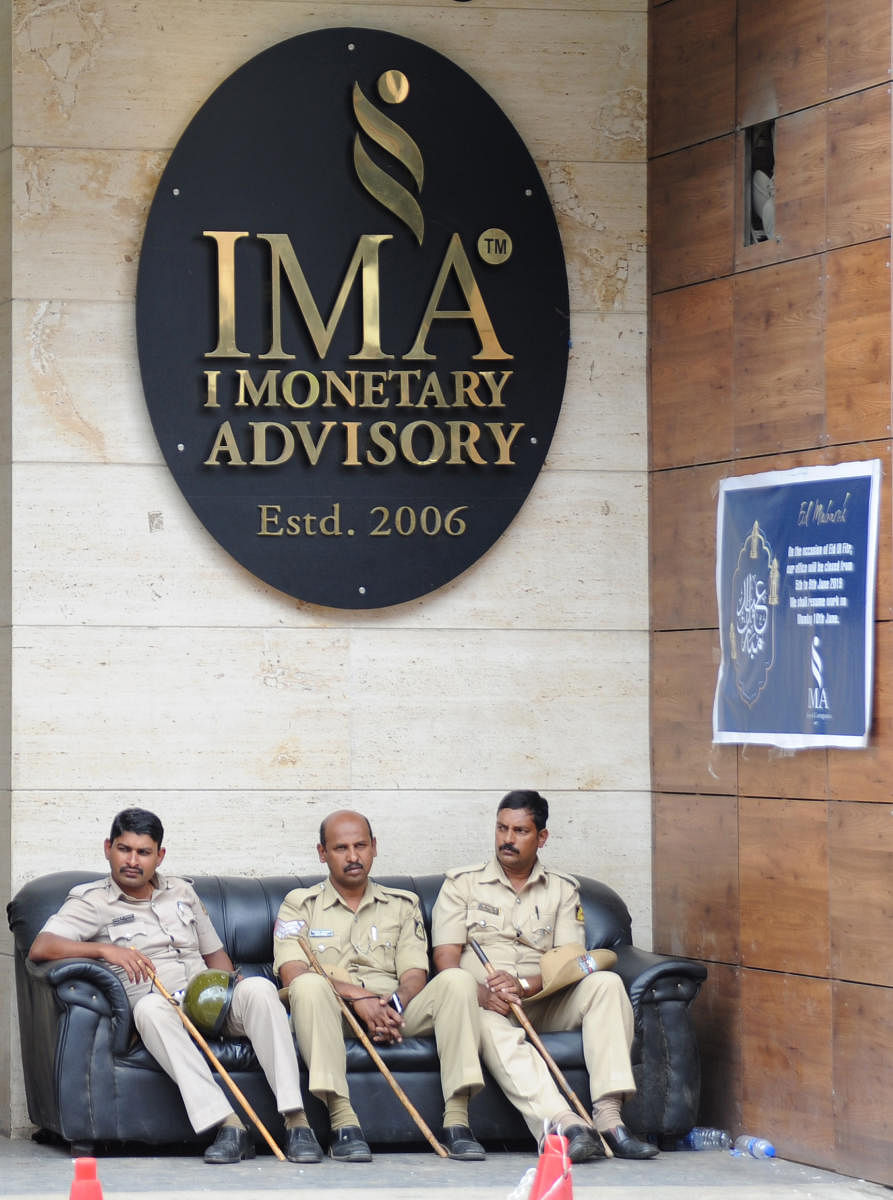

Mansoor is absconding after allegedly cheating more than 30,000 investors. During the course of an ongoing probe by the Special Investigation Team, both deputy commissioner and assistant commissioner of Bengaluru Urban district were arrested for accepting bribes to submit a report favouring IMA.