The recent hike of Rs 5, announced by the oil marketing companies, has increased the share of taxes to around 47 per cent of the total price.

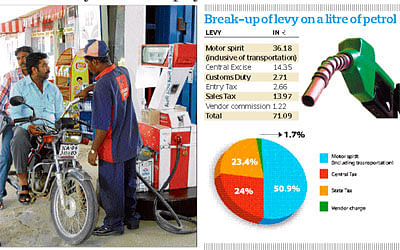

Petrol prices in Bangalore have gone up to Rs 71.09 per litre. Of this, Rs 17.06 goes to the Central government in the form of excise and customs levies.

Another Rs 16.63 goes into levies charged by the State government such as sales tax and entry tax. Put together, Rs 33.69 goes into just taxes every time you buy a litre of petrol. In contrast, the cost of crude petroleum, including the cost of transportation, comes to around Rs 36.18 per litre.

Prime source of revenue

The reason for high taxes is simple: excise tax and sales tax are prime sources of revenue for both the Centre and the State government, respectively. Petrol is subjected to four levies: Central excise duty, customs duty, entry tax, and sales tax. An employee from an oil marketing firm said: “We can reduce the burden on the customers if both the Central and State governments reduce these levies.

However, governments have their compulsions in spending, and they cannot but charge the levies to meet the expenditure on the spending."

The Centre charges a fixed excise tax of Rs 14.35 per litre, and customs duty of 7.5 per cent on crude oil.

Further, the State government charges 25 per cent sales tax on petrol. Besides, it also charges a five per cent entry tax that is levied on every litre of petrol and diesel that enters the State.

The State government does not follow VAT for petrol, and instead follows an ad valorem system. This means that a rise in crude prices automatically increases the tax levied, furthering the burden on consumers. While the Union government has recently shifted from an ad valorem system to a fixed-rate system for excise tax, the State government is yet to adopt the same.