Raising concerns over the inordinate delay on the part of banks to sanction loans to beneficiaries under Pradhan Mantri Awas Yojana (PMAY), the Karnataka government has urged lenders to speed up the process.

According to officials, of the 18,000 applications submitted by the government in the last six months, only 3,500 beneficiaries have been sanctioned loans by the banks.

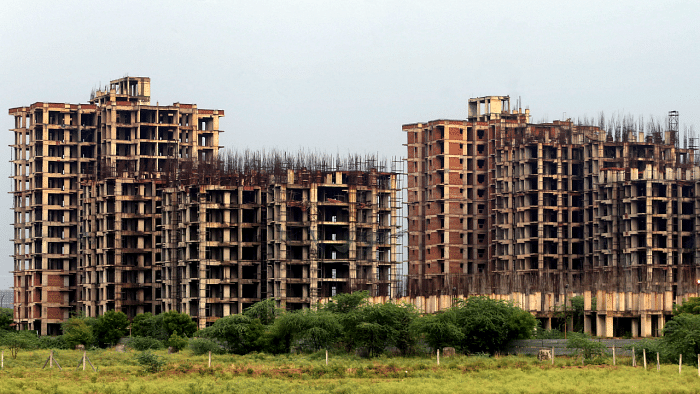

This delay is holding up the implementation of the government’s flagship programme of housing for the urban poor.

Speaking to DH, Additional Chief Secretary and Development Commissioner Vandita Sharma said it is an ongoing process.

While there was progress in the project, the government was pushing for a faster pace on the part of the banks and the departments concerned.

“While some banks are clearing them early, others are taking time. If an application is complete in all respects, it should not take more than 15 days for sanctioning the loan,” she said.

While the government is pushing banks to speed up the process, it is equally egging on agencies such as the Rajiv Gandhi Housing Corporation Limited (RGHCL) and the Karnataka Slum Development Board to send in their applications fast, the official added.

The government wants to ensure that the applications are complete with all details, without the beneficiaries having to make multiple visits to government offices.

Several beneficiaries may not be able to afford to forego their daily wages to spend time in these offices.

A recent state level bankers’ committee (SLBC) meeting noted that the government aimed to build 3.41 lakh houses, of which 2.07 are under construction, while the rest are yet to take off.

In RGHCL alone, of the 5,644 applications received, only 1,450 have been sanctioned. Also, of this, finally only 73 loans have been disbursed to beneficiaries. The SLBC, too, has urged banks to speed up the process.

The process had already been simplified with fewer documents for processing the application, an SLBC report in this regard noted.

Under PMAY, the cost of houses range from Rs 4.5 lakh to Rs 10.6 lakh. While the Centre provides Rs 2.7 lakh, the state will pitch in with Rs 3.5 lakh. The rest of it is the beneficiaries’ share.

Of this, Rs 10,000 is collected from their savings, while banks loan the rest of the amount.