The state government on Monday issued an order offering 100% waiver on penalties and interest payable by dealers under various pre-GST tax laws.

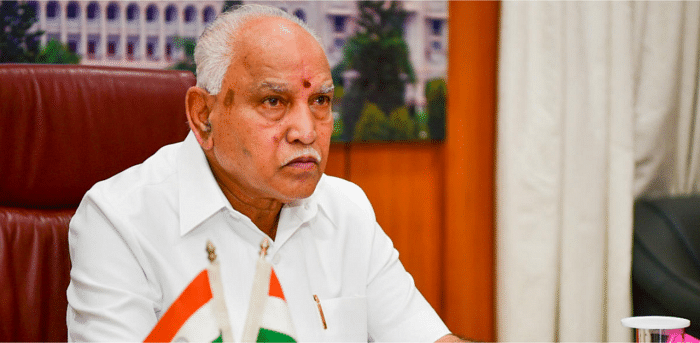

This is under the Karasamadhana scheme announced by Chief Minister B S Yediyurappa in the 2021-22 budget presented earlier in the month.

Arrears of penalties and interest payable under tax laws such as Karnataka Sales Tax Act, 1957, Karnataka Value Added Tax Act, 2003, Central Tax Act and others has to be assessed or reassessed before July 31. On completion of the assessment process a dealer has till October 31 to pay arrears in tax to the government.

Any discrepancies in the declaration made by the dealer will be addressed by November 15, after which penalties and interest on the tax will be waived.

Dealers who have no arrears of tax but only arrears of penalty and interest will also receive benefits under the scheme.

The order noted that any case or appeal filed by a dealer in courts regarding payment of taxes or penalties should be withdrawn to avail benefits under the scheme.

The scheme will not cover such dealers against whom state has filed appeals in various courts on charges of tax evasion. The order of waiver will be passed within 30 days from November 15, according to the order.

The Karasamadhana scheme is being introduced to complete the pre-GST legacy audit and to clear tax arrears expeditiously.