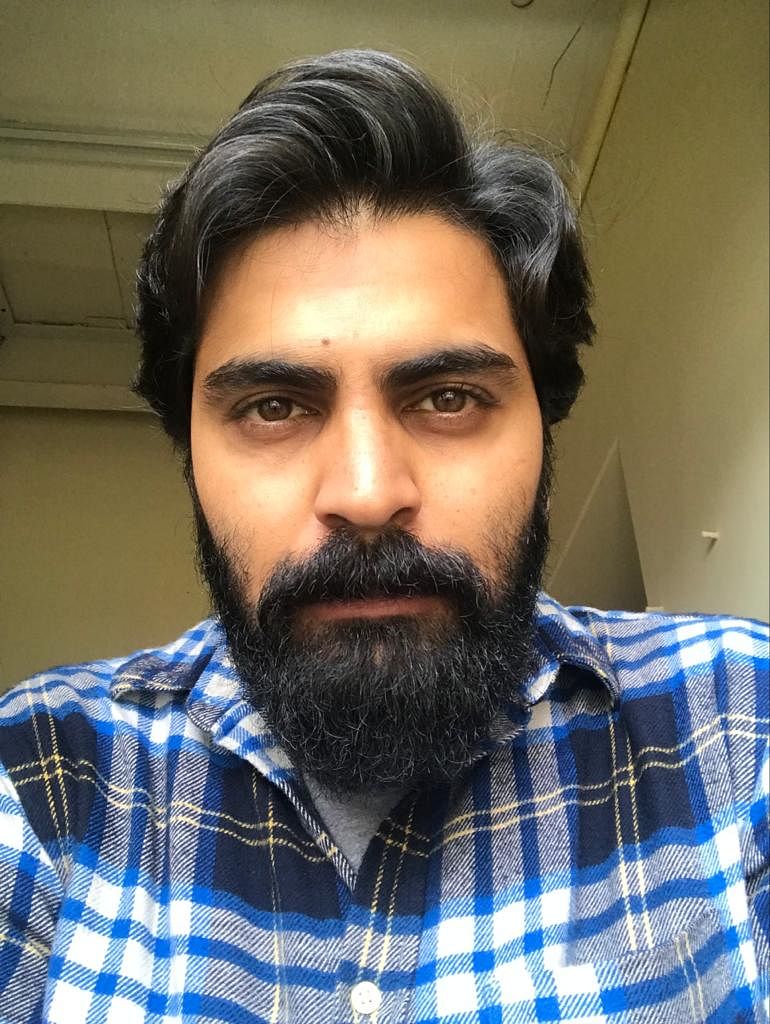

L K Atheeq, Additional Chief Secretary Finance Department in Bengaluru

Credit: DH Photo

Bengaluru: Amid rising fiscal pressures, Karnataka is trying out a new financing model under which state-run companies will borrow and lend loans amongst themselves instead of going to banks that charge a higher interest rate.

This plan, authorities believe, would lead to "decent" savings at a time when the Siddaramaiah administration is looking for newer ways to mobilise revenues and limit expenditure.

Under the Inter Corporate Deposits (ICD) system, public sector undertakings (PSU) that are making profits or have a cash surplus will lend to their poorer counterparts.

"We have rolled out ICD on a small scale," Additional Chief Secretary (Finance) L K Atheeq told DH.

"Instead of borrowing from banks at an interest rate of 9-9.5%, PSUs can borrow from other PSUs that have surplus cash. PSUs usually keep their surplus cash in bank deposits for which they get returns at a rate of about 7.5%. We are saying that they can lend to other PSUs at, say, an interest rate of 8%. This will be a win-win for PSUs," Atheeq explained.

While lending corporations will benefit, those borrowing can save on the cost of finance, Atheeq said. "Saving one per cent over hundreds of crores is decent," he said.

Under ICD, the Karnataka State Beverages Corporation Ltd has agreed to provide Rs 100 crore to the Karnataka Power Corporation Ltd.

According to Atheeq, Karnataka has 15-20 profit-making state-owned companies that will be involved in ICD operations.

It comes as no surprise that the government is looking at how ICD can help its power sector companies whose financial health "raises significant concerns for the state's fiscal stability", the Medium Term Fiscal Plan 2024-2027 stated earlier this year.

Electricity supply companies (Escoms) have outstanding power purchase dues, loans and accumulated losses of Rs 65,282 crore. KPCL has outstanding loans of Rs 31,145 crore, the MTFP said, calling it a "precarious" financial position.

Accordingly, various Escoms have told the finance department what they want from ICD.

The ICD is among the financing models recommended by consultancy giant Boston Consulting Group (BCG), which is advising the government on augmenting revenues. Atheeq said the government is also exploring infrastructure investment trusts (InvIT) and green bonds.