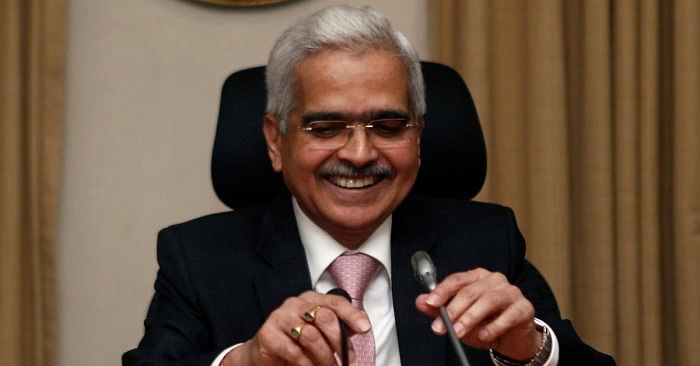

RBI Governor Shaktikanta Das on Monday clarified that the Rs 2,000 notes were withdrawn from circulation as it fulfilled its purpose.

"Rs 2,000 bank notes were introduced primarily to replenish the currency that was withdrawn following 2016 demonetisation. Today there are enough notes of other denominations in circulation. Even the circulation of Rs 2,000 notes as we have explained has come down from its peak of 6 lakh 73,000 crore to about 3 lakh 62,000 crores. The printing also has been stopped. The notes have completed their life cycle," the RBI Governor said.

The impact of the withdrawal on the economy will be "very very marginal", he said, adding Rs 2,000 currency notes made up for just 10.8 per cent of the total currency in circulation.

Das said that the move was part of the currency management operations of the Reserve Bank. "For a long time, the Reserve Bank has been following a clean note policy. From time to time, RBI withdraws notes of a particular series and issues fresh notes... We are withdrawing the Rs 2,000 notes from circulation but they continue as legal tender."

He added that banks have been advised to make necessary arrangements for exchange of Rs 2,000 notes.

"The RBI will be sensitive to difficulties faced by people regarding the exchange of Rs 2,000 bank notes," said Das.

He urged people to not rush to banks to exchange the notes.

"We have more than adequate quantities of printed notes already available in the system, not just with RBI but with currency chests operated by banks. There is no reason for worry. We have sufficient stocks, no need to worry."