In a recent interview to Bloomberg Television, Bill Gates, the world’s richest college dropout and third richest man, raised doubts about Bitcoin, the world’s most popular cryptocurrency. He said: “My general thought would be that if you have less money than Elon, you should probably watch out.”

The comment was in response to Elon Musk, the boss at electric car-maker Tesla, and a big votary of people buying and owning Bitcoin (though, of late, he has said that Bitcoin is overvalued).

Bitcoin is a cryptocurrency that has been around since 2009. It was supposedly invented by someone known as Satoshi Nakamoto but whose real identity or identities (given that it could even be a group of people), is/are not known.

Between September 3, 2020, and around noon on February 26, the price of bitcoin in US dollars, has gone up by a whopping 356%, and as I write this, it is quoting at around $46,350 per unit. And, not surprisingly, those investors who rode this wave are a confident lot.

They believe that bitcoin has the capacity to emerge as a parallel money system to the current paper money system run by governments and central banks around the world.

It is worth recalling here that Nakamoto invented Bitcoin in the aftermath of the financial crisis that broke out in mid-September 2008.

In the carnage that followed, the world economy was ready to get into the second Great Depression, with economic growth collapsing and even contracting in many countries.

The Western central banks printed and flooded the financial system with huge amounts of money. The idea was to drive down interest rates and encourage people to borrow and spend, and businesses to borrow and expand, with the hope that all this would drive economic growth.

This ability of central banks to create paper money out of thin air is referred to as the debasing of currency. In an earlier era, before World War I, much of the world was on a gold standard. Paper money was backed by gold (or silver, in some cases). In other words, the paper money was basically worth a certain weight of gold. Citizens could actually go to a bank and exchange their paper money for gold.

This system limited the ability of governments to print excessive paper money, given that if citizens came to know of it, they could walk into a bank and exchange it for gold. Hence, there was a danger of banks running out of gold if enough people wanting to convert their paper money into gold turned up at the banks.

This system got gradually dismantled between 1918 and 1971 as many countries around the world faced economic problems between and after the two World Wars. Also, as more countries of the world moved towards democracy, they realised that they needed a more flexible money system than the gold standard. This paved the way for the pure paper money system of today, where the money isn’t backed by anything other than just trust in the government.

Nakamoto clearly didn’t like the ability of the government and the central banks to create paper money out of thin air by printing it (or creating it digitally, for that matter). As he wrote on a message board in February 2009: “The central bank must be trusted not to debase the currency, but the history of fiat currencies is full of breaches of that trust. Banks must be trusted to hold our money and transfer it electronically, but they lend it out in waves of credit bubbles with barely a fraction in reserve.”

Nakamoto looked at a central bank’s ability to debase paper money as abuse of the trust people had in it. And Bitcoin was supposed to be a solution for this breach of trust -- a cryptocurrency, which did not use banks or any third party as a medium and the code for which has been written in such a way that only 21 million units can be created.

Currently, the number of Bitcoin in existence stands at 18.64 million units. Further, the paper money system which is run by governments and central banks is ultimately in the control of individuals running these institutions. The Bitcoin system is decentralised and has no owner.

These are the reasons offered by those who believe in bitcoin as to why the price of this cryptocurrency keeps going up and why it is the future of money. But is that actually the case? Not really. Here are three reasons:

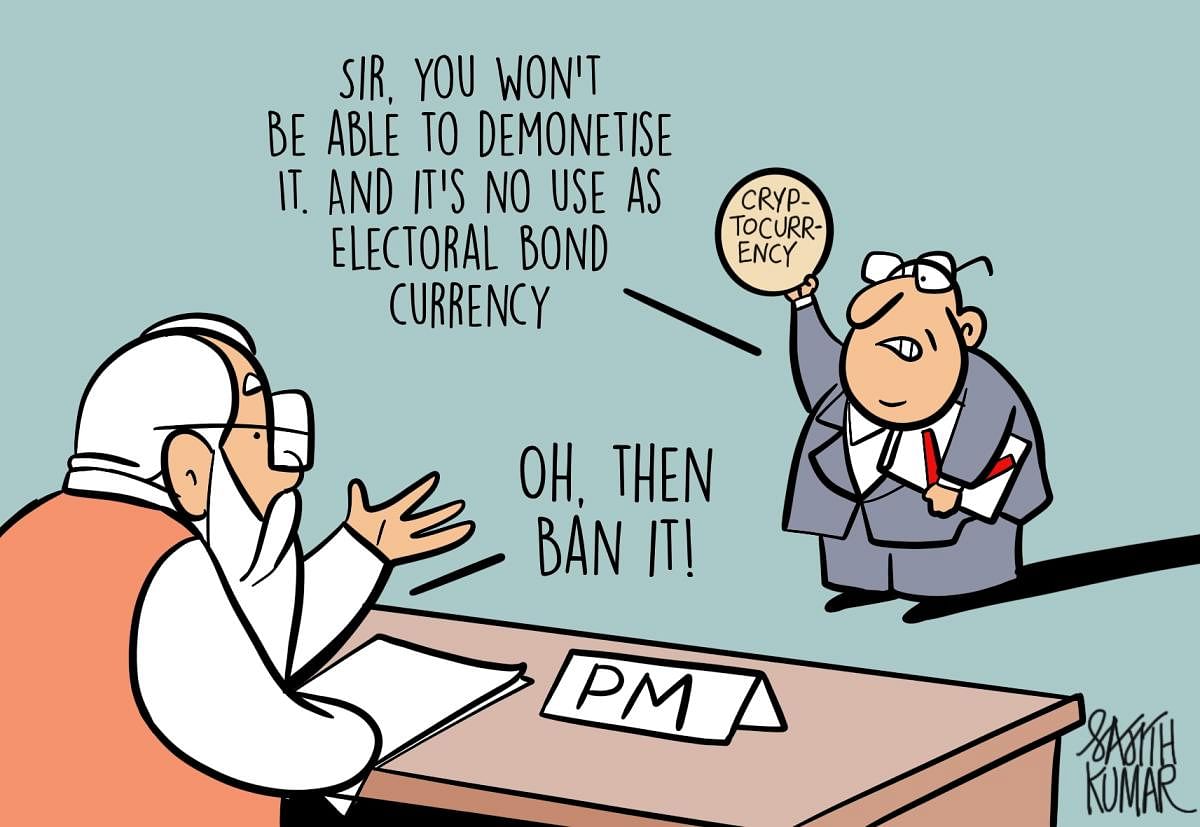

1) The rise of Bitcoin and other cryptocurrencies challenges the monopoly of the government and central banks to create money out of thin air. Hence, it is difficult to believe that governments around the world will let cryptocurrencies flourish. As Finance Minister Nirmala Sitharaman told the Rajya Sabha recently, “A high-level Inter-Ministerial Committee (IMC)…to study the issues related to virtual currencies…recommended in its report that all private cryptocurrencies, except any virtual currencies issued by the State, be prohibited in India.” The US Treasury Secretary, Janet Yellen, has also come down hard on cryptocurrencies in the recent past.

2) There is a limit to the number of Bitcoin that can be mined. While this is true in the context of just Bitcoin, it isn’t true in the context of cryptocurrencies in general. Anyone with enough technical knowledge can start a cryptocurrency in his or her own backyard. And, indeed, people do so all the time.

The point here is that the number of Bitcoin may not go up, but the number of Bitcoin-like assets will continue to go up in the years to come, as newer cryptocurrencies keep getting launched.

This also means that there is a distinct possibility that in the time to come, some new cryptocurrency might displace Bitcoin as the most popular cryptocurrency. Given this, Bitcoin believers are comfortable with the idea of a free market in money, where different forms of money compete with one another, and the ones the market believes are the best come out on top.

While competition in products is essential so that consumers get the best deal, the same cannot be said when it comes to different forms of money competing with each other.

Anyone who has studied the history of money would know that behind the evolution of standardised paper money backed by government lies the fact that there were too many forms of money going around and this caused needless confusion and built into the system huge costs of doing business. A lot of standardisation happened through the centuries and made lives easy for business and for people.

This is not to say that this system is perfect and there are no problems with it. But what the cryptocurrency believers propose is financial anarchy, with anyone and everyone being allowed to start their own money system. That’s not going to happen.

3) While the price of Bitcoin has gone up by more than 350% since September, there has been great price fluctuation along the way. On February 21, the price of Bitcoin was $57,434. Five days later, on February 26, as I was writing this, it was down by nearly a fifth to $46,349. Or take the period of six days between February 15 and February 21, when the price of Bitcoin rose by a fifth (or 20%) to $57,434.

If Bitcoin were actually money, what would this mean? When the price of money goes down, the price of things one can buy with it goes up (inflation). When the price of money goes up, the price of things that one can buy with it goes down (deflation).

If Bitcoin was money, given the volatility in its price, the world would be jumping from inflation one day to deflation the next, all the time. Any form of money to be accepted as such cannot exhibit such huge fluctuations. It cannot be going up by 20% in a period of six days and then coming down by 20% in the next five days. As the author and philosopher Nassim Nicholas Taleb tweeted on February 12 with regard to Bitcoin: “A currency is never supposed to be more volatile than what you buy and sell with it.”

Of course, all these reasons cannot stop the value of Bitcoin from going up as long as enough people keep believing that it will go up and keep buying it. The limited supply will keep pushing up its value. But this makes Bitcoin an excellent object of speculation, not a current or even future form of money. At the end of the day, Bitcoin is going up simply because…Bitcoin is going up. Don’t intellectualise it. Don’t go looking for reasons for it.

(The writer is the author of the Easy Money trilogy)