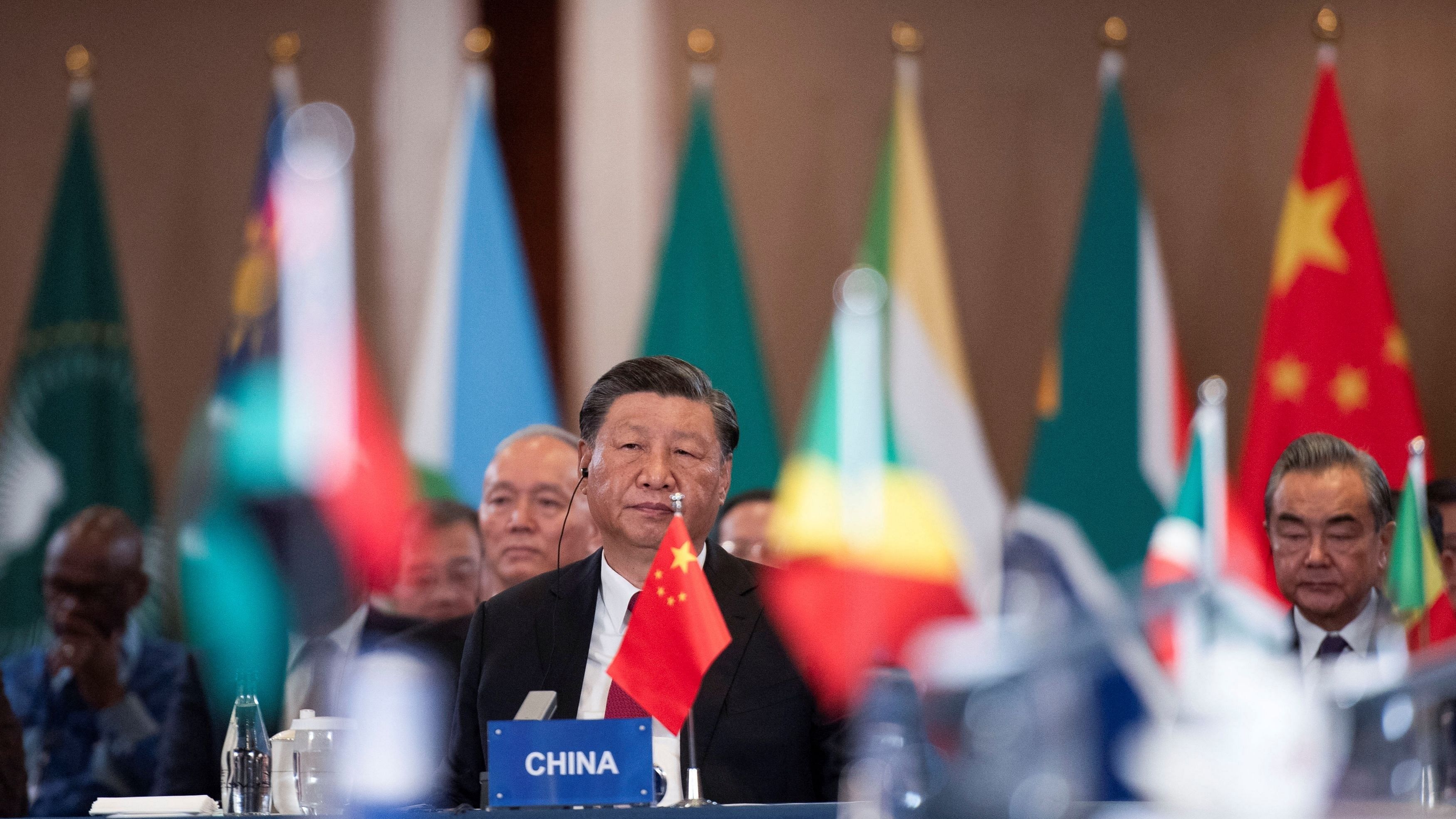

President of China Xi Jinping looks on at the China-Africa Leaders' Roundtable Dialogue on the last day of the BRICS Summit, in Johannesburg, South Africa.

Credit: Reuters Photo

In the just concluded BRICS Summit in Johannesburg, South Africa, there were reports that member countries will trade in local currencies.

In 2001, Jim O’Neill, then Chairperson of Goldman Sachs, coined the term BRIC in his report ‘Building Better Global Economic BRICs’. It highlighted the economic potential of the four economies (Brazil, Russia, India, and China), and suggested investing in them. Formalised in 2006, the first BRIC Summit was held in Russia in 2009. In 2010, South Africa was invited to join BRIC, making it BRICS. In the Johannesburg summit, BRICS has expanded to include six more members: Argentina, Egypt, Ethiopia, Iran, Saudi Arabia, and the United Arab Emirates.

In this article, we’ll keep the focus on the five existing members.

Interest in BRICS

Since 2009, BRICS has held 15 summits and has agreed upon three areas of co-operation: political and security co-operation, financial and economic co-operation, and cultural and people-to-people co-operation.

Under financial and economic co-operation, BRICS established the New Development Bank (NDB) in 2015. The purpose of the bank has been to provide financial support to emerging markets and developing countries for infrastructure development, sustainable development, and equity in power-sharing.

Until recently BRICS was not majorly featuring on the West’s radar as a potential grouping of any meaningful consequence. The 2020 Covid-19 pandemic, which upset global supply chains, saw economies looked inwards and regional ties/blocs came into the spotlight. The 2022 Russia-Ukraine war showed how the West, especially the United States, could weaponise the existing financial system against the Global South. These two events broke the already weak global order; this, in turn, led to renewed interest in BRICS, which comprises two of the largest economies in the world: China and India.

Growing trade

Of the many announcements at the Johannesburg summit, the proposal of settling international trade in local currencies has caught media attention. This is aimed at challenging the hegemony of US dollar (USD). A glance at NDB’s lending portfolio shows 67 per cent of loans are in USD, followed by Chinese Renminbi at 18 per cent.

The share of BRICS’ GDP as a percentage of world GDP was 12 per cent in 2001. In 2010, it was 19 per cent, and in 2022 it is at 26 per cent. The share of exports increased from 6 per cent in 2001 to 18 per cent in 2022. The share of imports increased from 6 per cent to 16 per cent in the same period. In sum, the share of BRICS’ trade to global trade increased from 12 per cent in 2001 to 34 per cent in 2022. Within BRICS, the share of intra BRICS trade is 10 per cent of its total trade in 2017.

Given the brief macroeconomic trends, BRICS has emerged as an important growth and trade bloc. The grouping can pose challenge to the USD. Earlier, there were talks of introducing a common BRICS currency, but it looks like a far-fetched idea. This has given way to the proposal of settling trade transactions in local currencies.

Chinese renminbi

How will this proposal of trade in local currencies work out? Will all the member countries agree to settle transactions in different currencies or one currency of a member country? As none of the local currencies are international currencies like the USD, it is unlikely that members will engage in multiple currencies. If there is one currency, which one would it be? No prizes for guessing; the Chinese renminbi, of course!

Much of the increase in BRICS’ share in GDP and trade is due to China. China’s share in GDP increased from 6 per cent in 2001 to 18 per cent in 2022. Likewise, the share of China in world trade increased from 5 per cent in 2001 to 21 per cent in 2022. China also dominates the intra-BRICS trade as it contributes nearly 50 per cent to it. China is a dominant trade partner with all the BRIC countries.

Therefore, if there is one currency which could replace the USD in BRICS’ international transactions, it is likely to be Chinese renminbi. This will serve Beijing’s broader interests. China has been trying to counter US hegemony and the USD’s supremacy for a while now. It has created multiple forums and has been lending aggressively to South Asian and African countries in the renminbi. There are also concerns that Beijing is using BRICS to counter Washington.

Balancing act

What does this mean for India? From a unipolar world where the US ruled politically and economically, now we are in a multipolar world. India is spreading its bets by being an active member of BRICS, and of the QUAD, along with the US, Japan, and Australia. Parallelly, India is also hosting the G-20, which is a bigger body of both developed and developing economies. Even within BRICS there are different power structures. In 2021, the NDB added Bangladesh and the UAE as new members, and in 2023 it added Egypt and Uruguay.

It is obviously a challenge to balance these multiple ideologies. India may support BRICS to weaken the importance of the USD but it may not be comfortable with the Chinese renminbi gaining currency. It’s a difficult balancing act for New Delhi.

(Amol Agrawal is an economist teaching at Ahmedabad University.)

Disclaimer: The views expressed above are the author's own. They do not necessarily reflect the views of DH.