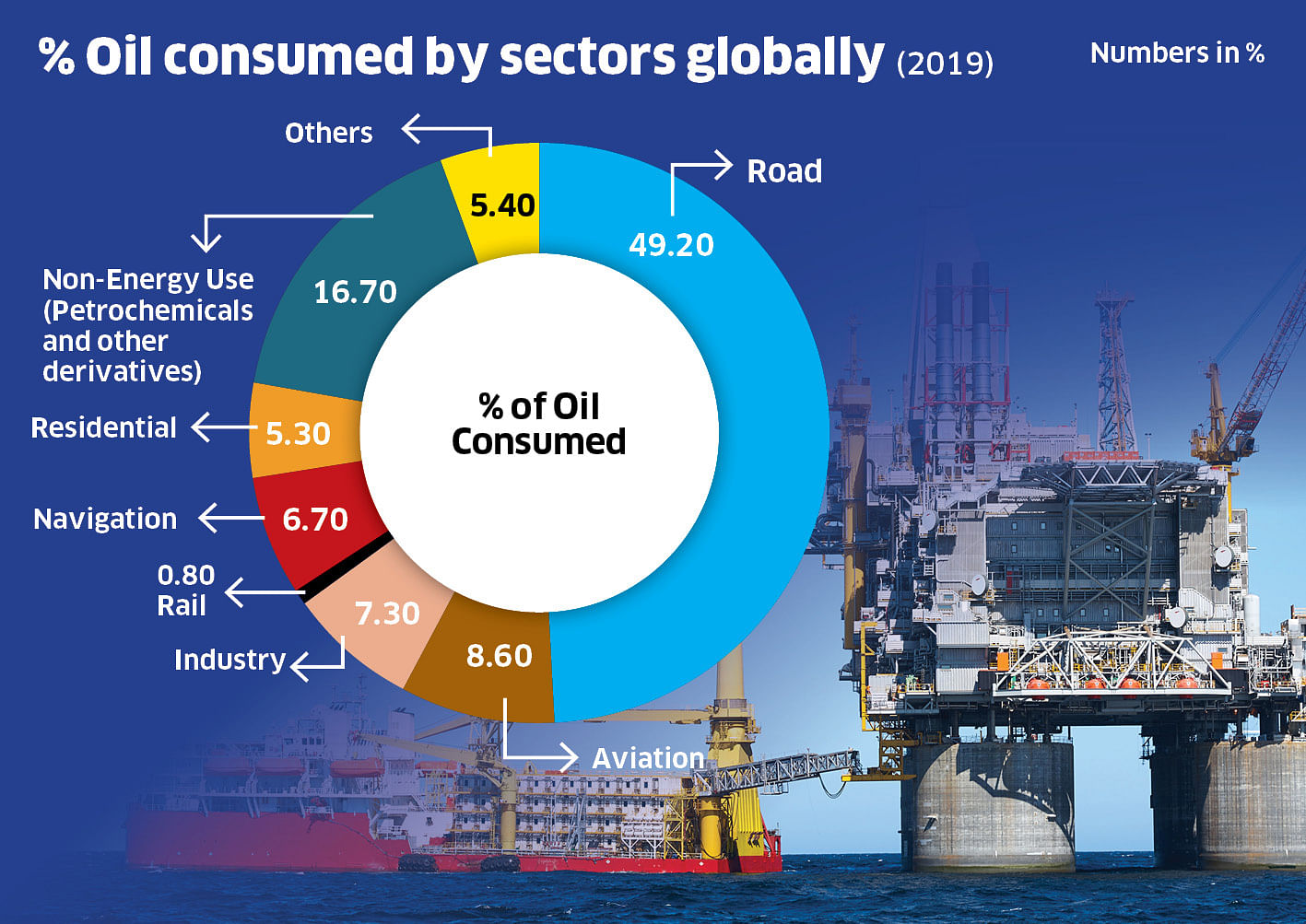

India’s rising population and earnings, coupled with total consumption will likely boost the demand for oil. The petroleum ministry anticipates that demand for petrol and diesel will continue strong until at least 2040. However, oil's share of total energy demand is expected to reduce gradually over the next few decades. As a result, to envision the economy post-oil, we must first understand the industries that are directly dependent on crude oil (see graph below).

It is evident that transportation or mobility across various modes — like road, air, railway, and sea — is one key theme with a major crude oil dependence. This is one industry where the reliance on crude oil is rapidly decreasing due to the burgeoning popularity of electric vehicles (EVs). The government expects EV sales penetration to be 40 percent for buses, 30 percent for individual automobiles, 70 percent for commercial vehicles, and 80 percent for two- and three-wheelers by 2030.

Also Read | OPEC cut bad news, but price stability likely

This leads to the million-dollar question: Will the EV adoption result in India’s import bill getting much-needed relief from crude imports? After all, India’s crude oil imports for 2021-22 were more than $120 billion — comprising 20 percent of the total imports, and the import numbers for FY23 are set to be over $150 billion (numbers for March 2023 are yet to be released).

India has always had to expend over $80 billion to import crude, except for the years in which the global crude prices witnessed massive declines or when the demand corners hit due to the Covid-19 pandemic. Therefore, to calculate if India can cut its import bill, we must take into account how we would acquire the ecosystem required for fossil fuel alternatives.

The essential cost component in any EV is the battery, which accounts for 30-40 percent of the total cost. Aside from that, how the electricity to charge these batteries will be sourced is an important question, as coal imports also have a high cost. India continues to rely largely on imports to manufacture lithium batteries. It will be critical for the government to ensure that in the long run the replacement of hydrocarbon (HC)-based fuel is accomplished through localisation — whether in terms of batteries or electrical requirements. The government has implemented a variety of initiatives, including PLI (Production linked incentive) schemes and ACC (Advanced Cell Chemistry) manufacturing schemes, as well as increased financial allocations to the MNRE (Ministry of New and Renewable Energy). The execution of these initiatives will be a key element in determining if India's import bill is reduced.

Coping With The Change

Even before the path to EV adoption in India was clear, the country’s automakers had started ramping up their investments in this space. There was a slew of new-age automakers in the two-wheeler EV industry, while the legacy players preferred to test the waters before making concentrated efforts in the sector. This was either through investments in pure-play EV companies (Hero Motocorp investing in Ather) or through partnerships and collaborations (Maruti collaborating with Toyota). Within the EV space, we might see various EV technologies co-exist. These will mainly include electrified vehicle technologies (xEVs), which consist of SHEV (Strong Hybrid Electric Vehicle), FCEV (Fuel cell Electric Vehicle), BEV (Battery Electric Vehicle), and PHEV (Plug-in Hybrid Electric Vehicle). Each EV variant can be expected to cater to the needs of different consumer segments.

Effect On Rural India

At first, it appeared that EVs were concentrated in urban India. Cities suffer from severe pollution issues, and since they have a larger population, they are more likely to have the necessary infrastructure for EV charging stations. However, rural India contributes to almost half of India’s GDP and houses more than 900 million of India’s population. Rural India would have some visible advantages in the EV ecosystem going by the developments in recent years.

While attempts have been made to eliminate power outages and boost rural electrification, solar panels on rural rooftops and solar parks are progressively becoming more commonplace. The lack of proper mechanisation of vehicles and equipment used for agricultural activities has long affected productivity in the past. Rising fuel costs have further compounded the problems. Rural India might experience a significant transition in the post-oil world if the price of electrical alternatives falls in the upcoming years, which is a major roadblock in the adoption of electrical alternatives right now.

What The Future Holds

When we talk about an oil-less world, we must remember that crude oil derivatives have applications in various industries. Crude-based derivatives are used in industries such as electronics, textiles, beauty products, medical supplies, etc. We might see a future where crude oil can be directly converted into chemicals instead of the current process of first converting it into fuel. Some industries, such as paints, have started exploring other alternatives like natural oils, bio-based materials, soybeans, and linseeds. Many of these advancements are still in their infancy.

All stakeholders in the value chain for crude oil will need to be flexible in how they handle this gradual transition away from oil. The next 10-20 years would be very interesting in this space as we might see newer technologies and newer business models from various companies figuring their way out towards a sustainable world.

[Parimal Ade (Twitter: @AdeParimal) is Founder, and Gaurav Jain (Twitter: @gaurav28jain) is Co-Founder, Investyadnya.in.]

Disclaimer: The views expressed above are the author's own. They do not necessarily reflect the views of DH.