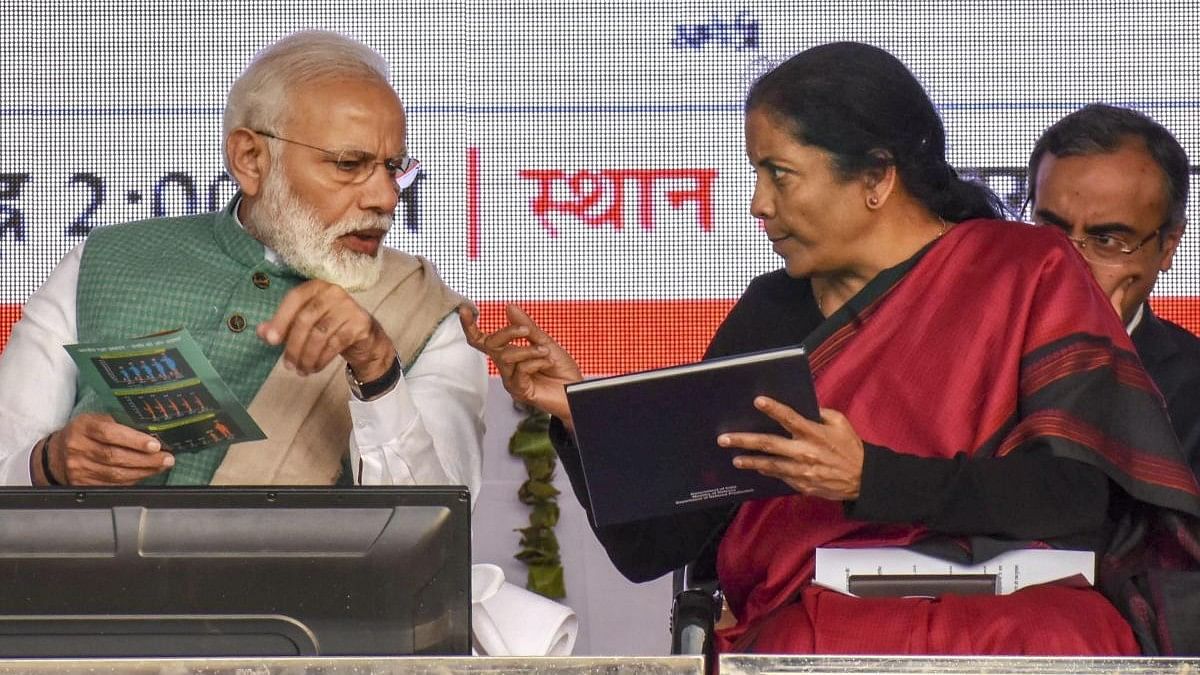

Prime Minister Narendra Modi with Union Defence Minister Nirmala Sitharaman.

Credit: PTI Photo

By Andy Mukherjee

Indian Prime Minister Narendra Modi sought a third five-year term by promising to march his country toward “Amrit Kaal,” an epoch of plentitude in Hindu astrology when the gates of pleasure will open to all.

Last week, however, the slogan, enthusiastically employed by Modi’s party in its election manifesto, received a quiet burial. In her first budget address of Modi 3.0, Finance Minister Nirmala Sitharaman stayed away from the phrase, even though variations of it had cropped up 30 times in her speeches about government finances in the previous two years.

And that was just as well. Now that a reduced parliamentary majority has rusted his shield of invincibility, Modi’s offer to voters is no longer a dream, but an awakening. Let the golden period of prosperity come when it will; it’s time for the middle class — some of the Indian leader’s most loyal supporters — to pay more taxes.

Trading in stocks and options, which has become a national craze since the pandemic, will now be taxed more strictly. That wasn’t entirely unexpected. But even on longer-term investing, the government will take away a bigger share of profits, including from buybacks. At the same time, the indexation benefit against inflation, which allowed people to report lower taxable profits, has been taken away on property sales although the capital-gains levy itself has been lowered to 12.5 per cent, from 20 per cent.

This was a rude jolt. In most major cities, those planning to sell homes acquired a decade or two ago may have less than they’d hoped for after paying taxes. The least that could have been done for them is to exempt capital gains before a relatively recent start date of, say, 2019.

That’s the path the UK took in 1988 to build support for the idea that income from work and wealth should be taxed equally. Alternatively, people could have been allowed to park their gains in bonds that raise money for public infrastructure — India’s railway tracks and signaling systems are desperate for modernization. Currently, there is a cap on how much of the profit can be reinvested in tax-saving debt.

The government says its aim is to simplify filings, and not to garner more revenue, though that’s not how the asset-owning folks are reading the changes. For the so-called Octopus Class, the 1 million or so super-elite spenders, there will be a withholding tax on handbags, watches, and other luxury items costing more than Rs 10 lakh ($12,000). This is on top of a goods and services tax, or GST, of 18 per cent to 28 per cent. The really wealthy, however, can always go to Dubai and Singapore to buy what they want. Those who are just comfortably off, on the other hand, are taxed even for funding their children’s education at foreign universities.

There is a lot to upset the middle class in this year’s tweaks to the tax code. The levy on individuals already accounts for 30 per cent of gross tax revenue, more than the 26 per cent contributed by companies.

Mind you, it’s still a tiny section of the 1.4 billion (140 crore) population, sandwiched between 800 million (80 crore) Indians claiming free rations and billionaires spending $600 million (Rs 5,024 crore) on weddings. Eight out of 10 Indian workers don’t earn a regular wage. Of those who do, fewer than 10 per cent make more than $600 (Rs 50,241) a month. How much more does Modi want to squeeze people who, believing in a bountiful “Amrit Kaal,” have been getting deeper into debt to make ends meet amid high inflation? Retail loans, including credit card and other unsecured debt, are now 1.5 times as high as bank credit to industry for working capital or expansion. In pre-Modi days, these loans were only two-fifths of what banks gave to firms.

Meanwhile, a low-tax regime for firms is not encouraging new investment. A hefty 2019 rebate, which has cost the exchequer $100 billion (Rs 8,37,360 crore), has added to corporate profits, but without meaningful employment creation. In 2020, New Delhi announced a further $24 billion (Rs 2,00,963 crore) in production-linked incentives for manufacturers. They’ve only added 850,000 positions so far. This is when India needs 8 million of them annually. In this budget, the government offered $24 billion for jobs and apprenticeships, finally acknowledging an employment crisis that cut into Modi’s votes.

In 2014 and 2019, a disproportionately higher share of rich and the middle-class voters backed Modi, compared with the poor. His more affluent cheerleaders had no problems when he stalled the economy in 2016 by an overnight ban on 86 per cent of the country's cash. A few months later, he imposed a poorly constructed GST that drove out smaller firms from production networks. During the 2020 pandemic, Modi sent millions of urban, blue-collar workers back to their villages at a four-hour notice. The three shocks shut down 6 million (60 lakh) informal enterprises.

All through, the middle class voted for mollycoddling of large firms and neglect of final demand. But in this election, the rich-poor gap among Modi voters narrowed significantly. The faith in Modinomics is eroding, even though it has done its job of elevating asset prices — and turning software code-writers into day traders.

Just a couple of months back, at the height of a bruising poll campaign, India’s Hindu right-wing prime minister was accusing the opposition of plotting to take away private property for redistribution among the country’s minority Muslims. Now he’s doing the taking, and his fan club has to pay — with or without “Amrit Kaal.”