The Union Budget 2021 is a mixed bag: High on rhetoric with worrisome outlays in the budget document’s fine print. The most important takeaway is that agriculture and allied activities have been given an important place in the Budget speech. Indeed, taxes imposed for their cause. One need not be surprised if there is resentment against the supposed substantial government support to agriculture in the aftermath of the imposition of a sharp increase in Agriculture Development and Infrastructure (AIDC) Cess with the imposition of customs duties on import of select products including petrol and diesel. The rising cost of diesel will only add to the problems of the farming community.

Outlays on agriculture

The budgeted expenditure on Agriculture and allied activities in 2021-22 is estimated at Rs 1,48,301 crore against Revised Estimates of Rs. 1,45,355 crore in 2020-21, a marginal increase. The revenue expenditure related to the Department of Agriculture, Cooperation and Farmers’ Welfare as per Budget Estimates for 2021-2022 are below the 2020-21 estimates: Rs. 105,018.81 crore against Rs. 1,16,490 crore with most central subsidies related to agriculture receiving insignificant or no increases.

A significant announcement is an increase in agricultural credit target to Rs. 16.5 lakh crore. The other promises relate to rural and agricultural infrastructure development – those related to spending increases on Rural Infrastructure Development Fund (RIDF), minor irrigation fund, availability of agriculture infrastructure fund to APMCs, integration of another 1000 Mandis with e-NAM and increased outlay for promotion of Farmers’ Producers Organisations (FPOs).

The fine print of the budget indicates a significant infrastructure bet is on the national rural drinking water mission which has seen an increased outlay from Rs 11,000 crore (RE: 2020-21) to Rs 50,011 crore (BE 2021-22). There is a sharp reduction in the allotment for National Rural Employment Guarantee Scheme – a decline from Rs 1.11 crores to Rs 73,000 crores while PM-Kisan has remained constant at Rs 65,000 crores. There is a sharp decline in nutrient-based subsidy (Rs 18,288 crore) and urea subsidy (Rs 36,189 crore).

Realising promises

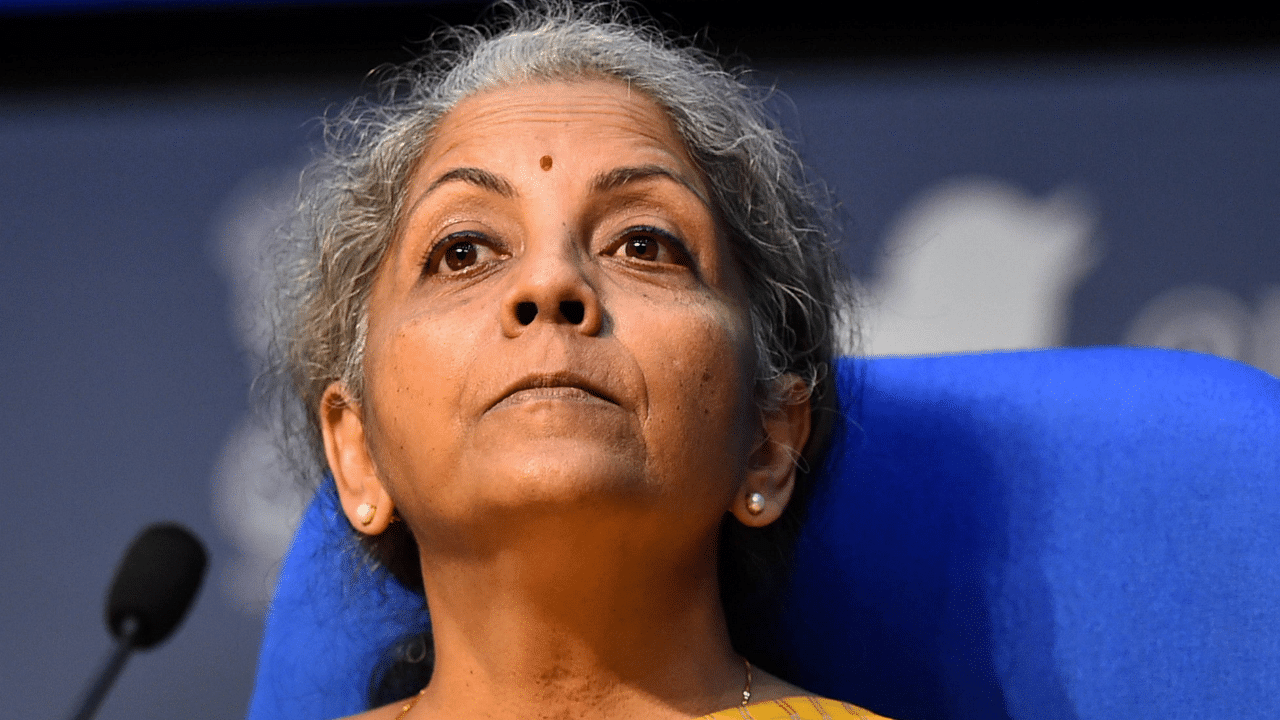

The Finance Minister spent time comparing the benefits for farmers from the increase in MSP vis-à-vis 2013-14. Unfortunately, the increase does not seem as large as claimed in absolute numbers when we consider the fact that the quantum of food grain production has increased by about 11 per cent in the same period and 16 per cent compared to 2014-15.

The government seems to have bet the house on rural infrastructure building as the way to reinvigorate the rural economy rather than putting more money directly into the hands of the farmers and rural economy. Of course, this could change in the next season if there is a substantial increase in MSP or a rise in food inflation in the next few months. The budget expenditure estimates seem to indicate that the headline figures may not be of direct help to most agricultural households and any improvement in incomes may be linked to the larger economic revival.

The large changes in some outlays seem to reinforce the belief that the bet on private and PPP investments in infrastructure in the context of the controversial farm laws seems to be the major if not the only plan under consideration of the government regarding agriculture.

The sharp increase in priority sector lending (PSL) is welcome but that increase needs to be seen in the context of the farm laws where a large part of the trade in agricultural products and new entrant entities will now be eligible for subsidised lending. This combined with the poor reach of Kisan Credit Card (KCC) does not give much confidence that things may improve dramatically. Moreso, in the context of a 2019 RBI Internal Working Group paper which pointed out that KCC penetration was only 10.5 per cent of the total agricultural households. Thus, increasing PSL lending target without a large increase in allotment for small, marginal and medium farmers who comprise about 86 per cent of the agricultural producers may be of little direct help at the ground level.

At this juncture, one can only hope that the money collected on the new cess will be utilised rather than meet the same fate as the road cess which remains underutilised. The government needs to quickly clarify how the proceeds of the cess, levied on a few products, will be utilised since the Agriculture Infrastructure Fund (AIF) has seen a paltry increase from Rs. 208 crores to Rs. 900 crores – a not so enticing figure considering the expected large collections that are likely to accrue with the cess on petrol and diesel and the problems in agriculture.

(S Ananth is an independent researcher and advocate based in Andhra Pradesh. Views are strictly personal)

Disclaimer: The views expressed above are the author's own. They do not necessarily reflect the views of DH.