RBI MPC Meet highlights: Cardless cash withdrawal to be made available at all bank branches and ATMs via UPI

That's all for today readers! Thank you for tuning in to our coverage of the RBI MPC decisions. For more latest news visit www.deccanherald.com.

RBI MPC keeps repo rate unchanged at 4%, lowers FY23 growth forecast to 7.2%

The monetary policy committee held the lending rate, or the repo rate, at 4 per cent. The reverse repo rate, or the key borrowing rate, was also kept unchanged at 3.35 per cent. But the central bank said it would restore the width of the liquidity adjustment facility to 50 basis points, which was seen as a first step to move away from the ultra loose monetary policy embraced during the Covid-19 pandemic.

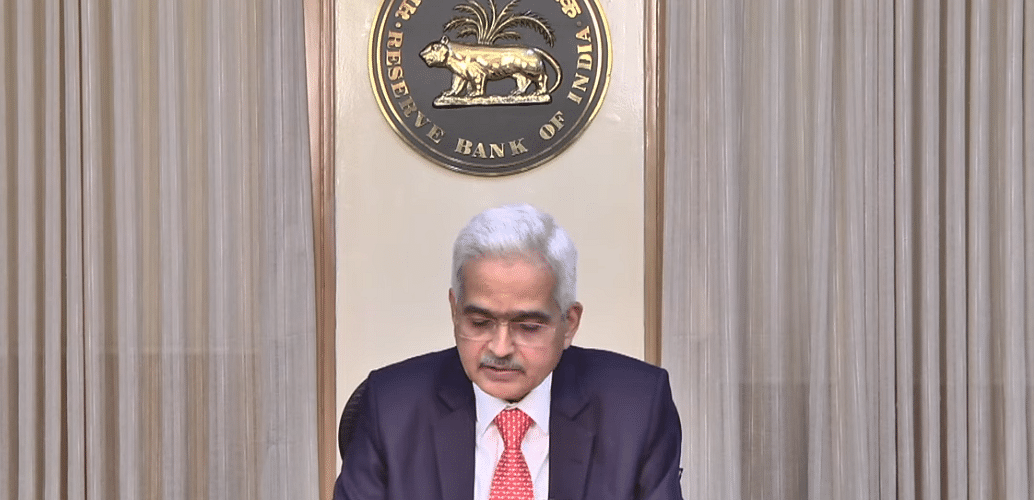

Key announcements made by Governor Shaktikanta Das

> Held-to-maturity limit to revert to 22% of banks' net demand and time liabilities in FY24.

> RBI also proposes a panel to review status of customer service at RBI-regulated entities.

> Cardless cash withdrawal will be made available at all bank branch and ATMs via UPI, to prevent frauds. To secure payment systems, propose guidelines for such operators.

> BBPS has seen rise in volumes, to encourage this further, the RBI has proposed to reduce networth requirement for such entities to Rs 25 crore against Rs 100 crore.

The SDF, MSF will be available from 5:30 pm till midnight all days of the week. Money market opening time restore to 9:00 am, which is the pre-pandemic time.